knoxville tn sales tax rate 2020

24638 per 100 assessed value. County and city taxes.

Northeast Tn Counties See Huge Sales Tax Growth In Wake Of Internet Tax Law Wjhl Tri Cities News Weather

The Knoxville sales tax rate is 0.

. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. This includes the sales tax rates on the state county city and special levels. 2020 rates included for use while preparing your income tax deduction.

Did South Dakota v. 212 per 100 assessed value. Opry Mills Breakfast Restaurants.

Essex Ct Pizza Restaurants. This is the total of state and county sales tax rates. Johnson City TN 37601 Knoxville TN 37914 423 854-5321 865 594-6100.

Soldier For Life Fort Campbell. 31 rows The latest sales tax rates for cities in Tennessee TN state. The minimum combined 2022 sales tax rate for Knox County Tennessee is.

City Property Tax Search Pay Online. City Property Tax Rate. City of Knoxville Revenue Office.

Did South Dakota v. 05 lower than the maximum sales tax in TN. La Vergne TN Sales Tax Rate.

Has impacted many state nexus laws and sales tax collection requirements. To review the rules in. The current total local sales tax rate in Knox County TN is 9250.

What is the sales tax rate in Knoxville Tennessee. Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum sales tax rate in Knox County is 975 not including any city or special district taxes. The Illinois sales tax rate is currently.

State Sales Tax is 7 of purchase price less total value of trade in. This rate includes any state county city and local sales taxes. The Knoxville sales tax rate is.

The latest sales tax rate for Knoxville PA. There is no applicable city tax or special tax. The 2018 United States Supreme Court decision in South Dakota v.

2020 Brice St Knoxville TN 37917-4137 is a single-family home listed for-sale at 234900. Local collection fee is 1. The Knox County Sales Tax is collected by the merchant on all qualifying sales made within Knox County.

The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax. 67-6-228 state and local sales tax rates. The County sales tax rate is.

Knoxville is located within Knox County Tennessee. The Knoxville sales tax rate is. The state of Tennessee also announced that for 2020 only on the weekend of Aug.

This is the total of state county and city sales tax rates. Lowest sales tax 85 Highest sales tax 975 Tennessee Sales Tax. The Tennessee sales tax rate is currently 7.

Knoxville TN 37902. The average cumulative sales tax rate in Knoxville Tennessee is 925. 2020 rates included for use while preparing your income tax deduction.

Changes to the Sales and Use Tax Guide for 2020 1 Marketplace facilitators that make or facilitate more than 100000 in sales to Tennessee. The minimum combined 2022 sales tax rate for Knoxville Illinois is. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax.

The December 2020 total local sales tax rate was also 6000. This table shows the total sales tax rates for all cities and towns in Knox County including all local taxes. This is the total of state county and city sales tax rates.

Wayfair Inc affect Illinois. Delivery Spanish Fork Restaurants. Tax Sale 10 Properties PDF Summary of Tax Sale Process and General Information Tax sale dates are determined by court proceedings and will be listed accordingly.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is 925. Did South Dakota v. Property tax rates.

Income Tax Rate Indonesia. And prepared food including restaurant meals and some premade supermarket items are charged at a. Within Knoxville there are around 31 zip codes with the most populous zip code being 37918.

Knoxville TN Sales Tax Rate. Restaurants In Matthews Nc That Deliver. Wayfair Inc affect Alabama.

Last item for navigation. The Tennessee state sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v.

Average Sales Tax With Local. Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275. This rate includes any state county city and local sales taxes.

The sales tax rate does not vary based on zip code. Knoxville Tn Vehicle Sales Tax. Sales Tax Calculator Sales Tax Table.

What is the sales tax rate in Knox County. TN Sales Tax Rate. The Knox County sales tax rate is.

Call 865 215-2385 with further questions. Johnson City 423 854-5321. Knox County collects a 225 local sales tax the maximum local sales tax.

The December 2020 total local sales tax rate was also 9250. Knoxville TN 37918 Phone. The County sales tax rate is 225.

What is the sales tax rate in Knoxville Illinois. Aviation fuel actually used in the Charges of 15 or less are. For tax rates in other cities see Tennessee sales taxes by city and county.

County Property Tax Rate. 2020 rates included for use while preparing your income tax deduction. 2022 List of Tennessee Local Sales Tax Rates.

Sales Tax Breakdown. The latest sales tax rate for Knox County TN. You can print a 925 sales tax table here.

Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275. Monday - Friday 800 am - 430 pm More Information. Standard fees and sales tax rates are listed below.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945.

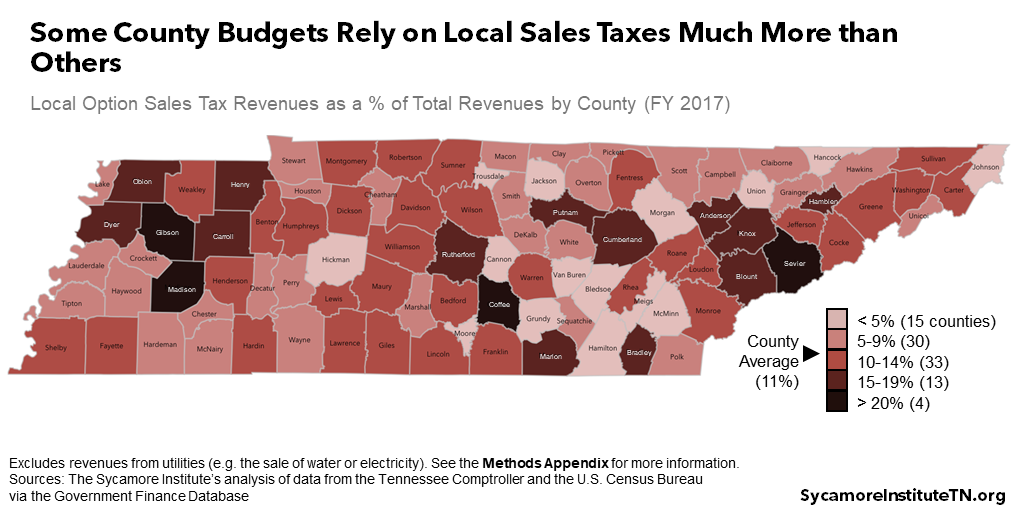

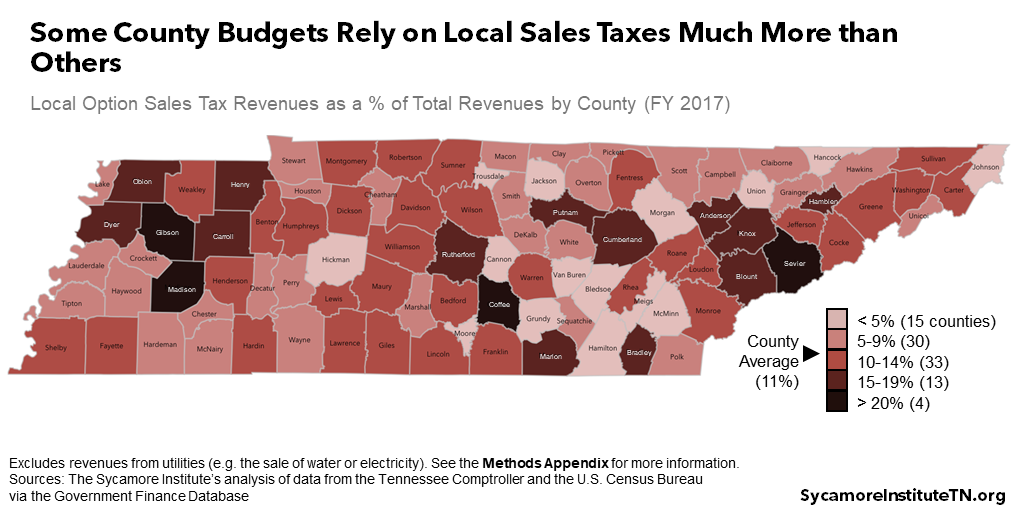

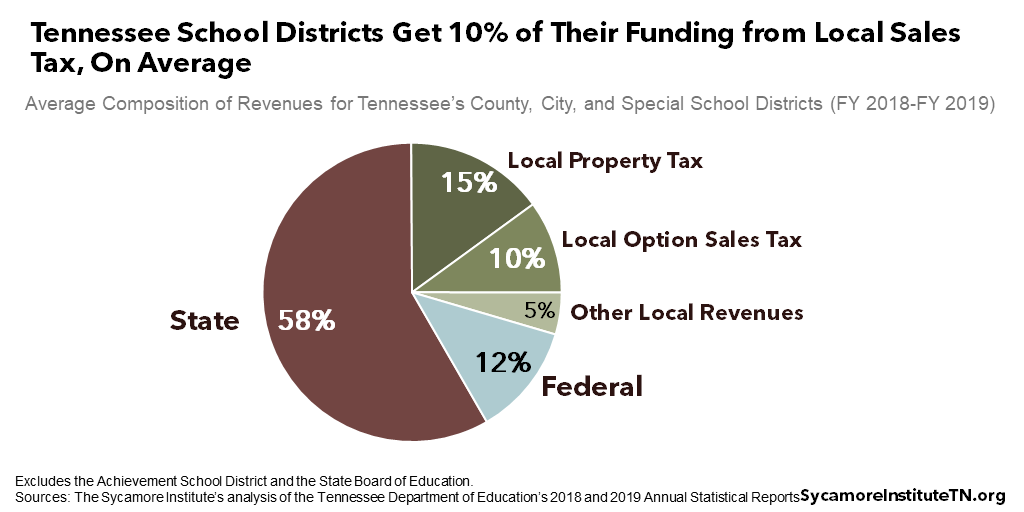

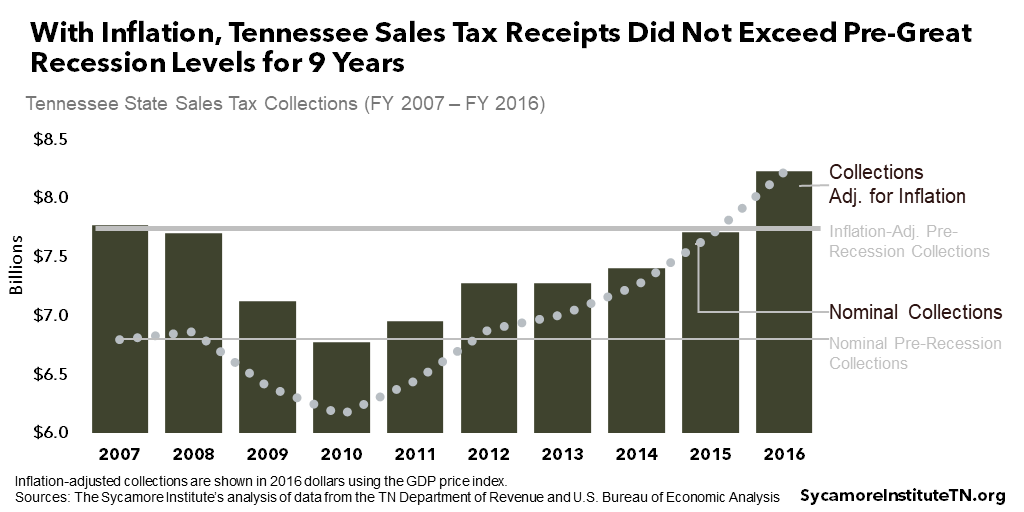

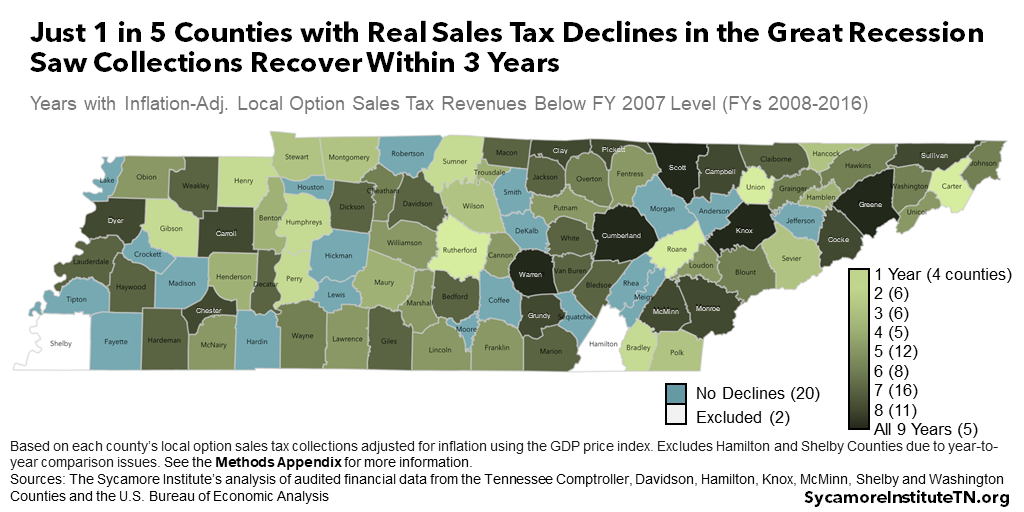

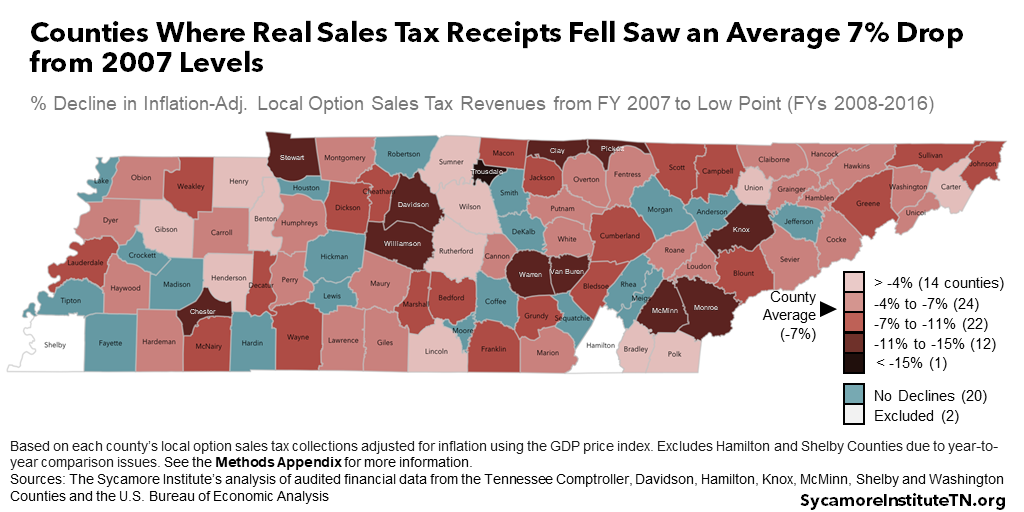

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

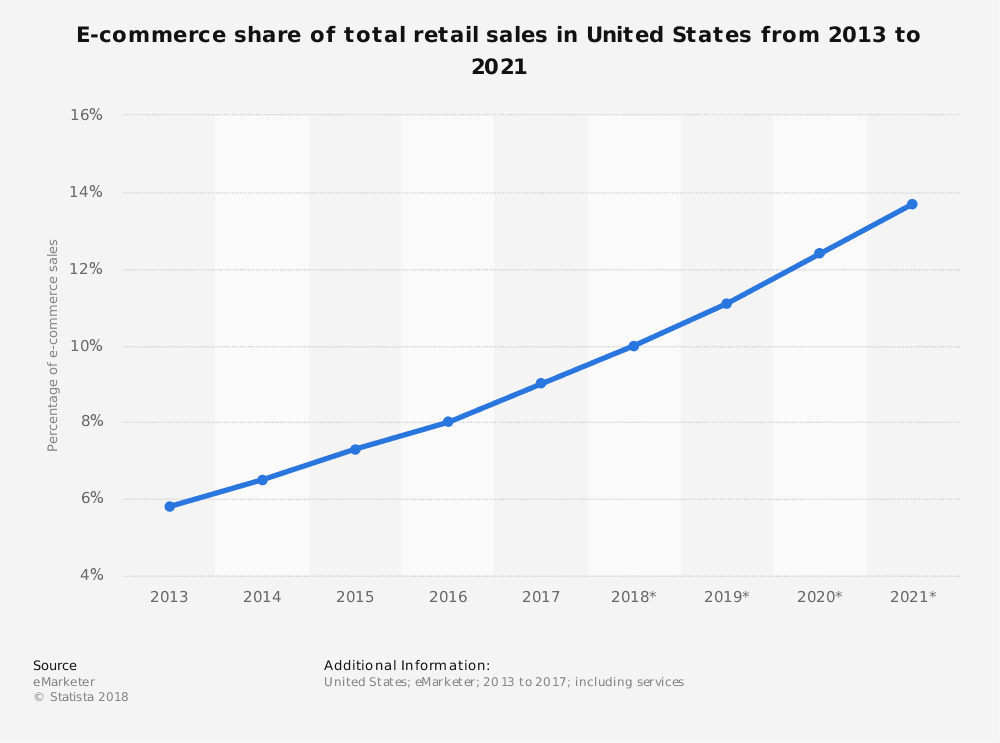

3 Things You Need To Know About Internet Sales Tax After Wayfair Red Stag Fulfillment

Northeast Tn Counties See Huge Sales Tax Growth In Wake Of Internet Tax Law Wjhl Tri Cities News Weather

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

File Sales Tax By County Webp Wikimedia Commons

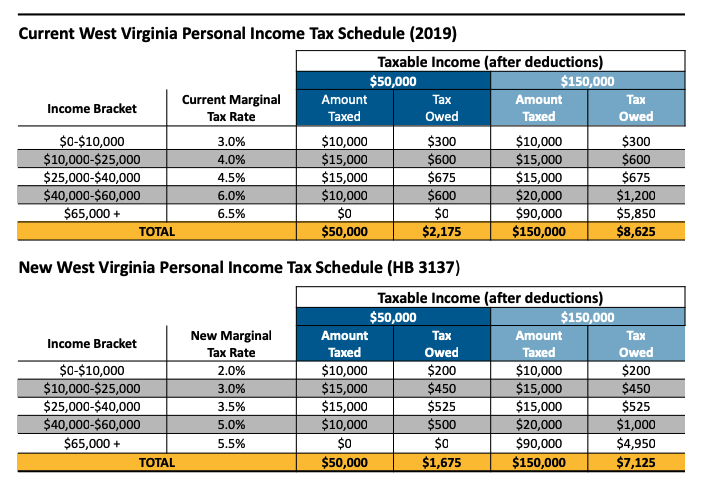

House Income Tax Cut Plan Mostly Benefits Wealthy And Puts Large Holes In The State Budget Hb 3137 West Virginia Center On Budget Policy

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Sales Tax On Grocery Items Taxjar

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue